Real Currencies

Inflation? Deflation? Stagflation?

Inflation is one of the Internet’s favorite buzzwords. But what are we really talking about? There’s more to it than most think.

Two common misunderstandings obscure the issue: mixing two different

definitions and ignoring the different behavior of inflation in

different monetary systems.

The first issue is fairly well known: there are two commonly used definitions for inflation.

The classical definition for inflation is a growing money supply.

The ‘modern’ definition is rising prices.

The classical definition is much better. Inflation may or may not

result in rising prices. And, as we will see, in today’s system the

rising prices are not caused by inflation.

A different thing in different systems

The second thing to keep in mind is that inflation means different things under different systems.

The second thing to keep in mind is that inflation means different things under different systems.

In a debt free system, simple money printing and spending into

circulation a la the Greenback or Social Credit, the situation is the

most straight forward. When the economy is operating at near maximum

capacity adding more money to the money supply will lead to rising

prices. If the economy grows, more money must be added to finance the

additional trade and maintain full employment.

In our current system the situation is far more complex because there

is interest on the money supply and this leads to all sorts of

unexpected and counter intuitive side effects.

The basic problem is that if there is interest there is never enough

money to pay of the debt + interest, because only the debt is created.

Mathematically perfected economy™ provides us with the basic math.

It looks like this: P + I > P where P is the Principal and I is Interest.

It looks like this: P + I > P where P is the Principal and I is Interest.

What this means is that the demand for money is always more than

there is in circulation. If P = 100 and I = 5% then P + I = 105, while

there is only 100.

Thankfully the banker is kind enough to lend us the 5 to pay the

interest also. Which means that after a year the money supply will be

105. But the demand for money will be 105 + I. etc.

This means inflation according to the classical definition. But do

prices rise? No, because the effective money supply remains the same:

all the extra money is just being created to pay off the interest.

So interest on the money supply has a deflationary effect.

When the money supply is paper based, the banker can create new credit

to finance interest payments, but that extra credit in turn will require

debt service also.

With a Gold Standard the situation would be much worse: because the

bankers would not be able to create extra Gold to pay for the interest, there would be eternal deflation because of ever higher interest costs on the circulating Gold, leaving ever less for normal trade.

So in our current system inflation is inevitable, but we do not

expect rising prices because of a growing money supply. The money

available for trade remains stable while the money supply itself grows.

Still we have seen that the Dollar has lost 97% of its purchasing power since 1913. So how can this be?

Well, since the money supply is interest bearing debt and since the

money supply grows, the cost for money must grow also. And this is what

is driving up prices all through the West: ever higher cost for capital

as a result of an ever growing money supply.

At this point costs for capital already account for 45% of prices we pay.

This also explains why we must have economic growth every year: it is

to pay off ever more interest. If the economy does not grow, we would

see real incomes decline. In fact, over the last few decades, since the

end of the post war boom in the late seventies real wages have been

declining throughout the West. The reason being that the economy grows

slower than capital costs.

Recapping: we have inflation in the classical meaning of the word,

but this is not causing prices to rise as the effective money supply

available for trade remains the same. Prices still rise, but this is not

the result of inflation, but because of ever more interest payed over

an ever growing money supply.

The Current Depression

So what is our current situation? Are we facing (hyper) inflation? The standard case for hyperinflation is this graph:

This is the Fed Balance Sheet: it certainly suggests massive expansion.

This is the Fed Balance Sheet: it certainly suggests massive expansion.

So what is our current situation? Are we facing (hyper) inflation? The standard case for hyperinflation is this graph:

This is the Fed Balance Sheet: it certainly suggests massive expansion.

This is the Fed Balance Sheet: it certainly suggests massive expansion.

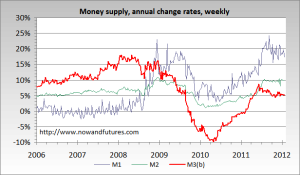

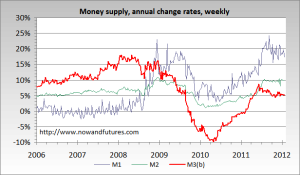

But here’s the graph showing the growth of the money supply:

As

we can see M1 (cash + liquid assets) started to grow rapidly in the

aftermath of Lehman’s demise. But M3 (a wider definition of the money

supply, including assets harder to liquidate) started tanking badly.

Even today it is growing much slower than before the depression began.

And how about this graph:

As

we can see M1 (cash + liquid assets) started to grow rapidly in the

aftermath of Lehman’s demise. But M3 (a wider definition of the money

supply, including assets harder to liquidate) started tanking badly.

Even today it is growing much slower than before the depression began.

And how about this graph:

This

is the velocity of circulation. The real money supply is money times

circulation and slower circulation means a smaller effective money

supply.

This

is the velocity of circulation. The real money supply is money times

circulation and slower circulation means a smaller effective money

supply.

As

we can see M1 (cash + liquid assets) started to grow rapidly in the

aftermath of Lehman’s demise. But M3 (a wider definition of the money

supply, including assets harder to liquidate) started tanking badly.

Even today it is growing much slower than before the depression began.

And how about this graph:

As

we can see M1 (cash + liquid assets) started to grow rapidly in the

aftermath of Lehman’s demise. But M3 (a wider definition of the money

supply, including assets harder to liquidate) started tanking badly.

Even today it is growing much slower than before the depression began.

And how about this graph: This

is the velocity of circulation. The real money supply is money times

circulation and slower circulation means a smaller effective money

supply.

This

is the velocity of circulation. The real money supply is money times

circulation and slower circulation means a smaller effective money

supply.

This is why the Fed started printing extra money, leading to an

expanding M1: the real monetary base as expressed with M3 was declining

and a horrible contraction of the economy would have resulted without

the Fed’s interventions.

When we look at prices, we get conflicting information. Paper assets

and real estate are much down since 2008. But prices for food and energy

are rising. Meanwhile the economy is tanking. This combination is known as stagflation.

Asset prices are down due to a contracting money supply as seen in

the stats. Rising prices in the primary sector are explained by

speculation on the commodity markets, driving up prices. These price

rises are passed on throughout the supply chain. But this is not

inflation: it is not a growing money supply that is causing these price

rises, it is artificial demand created by Hedge Funds and the like.

Current Government reports on inflation suggest there is no problem.

The Fed says inflation is about 2%. But its figures are unreliable: over

the last decades the methodology to calculate the CPI has been

manipulated to show lower numbers. Shadowstats, using the old ways, reports inflation of about 6%. This is relatively high, but still not quite hyperinflationary.

For the time being we can expect rising prices for our daily needs,

while assets will continue to be depressed. In the longer run the

question is whether the Fed can take the extra liquidity it created out

of the system when velocity recovers. If it can’t we can expect more

rising prices. But as long as the economy remains depressed as it is, we

will have a combination of deflationary pressures in the domestic

economy as a result of limited lending by the banks, combined with

upward price pressures due to speculation on the commodity markets.

So why is Gold rising?

Normally speaking Gold would be depressed during deflation. So why has it been appreciating so much? Clearly it’s not just a hedge against inflation: it has appreciated too much for that.

Normally speaking Gold would be depressed during deflation. So why has it been appreciating so much? Clearly it’s not just a hedge against inflation: it has appreciated too much for that.

The point is that Gold is regaining monetary status and more and more

people are betting it will be money again. Demand for Gold will remain

high as more and more nations are abandoning the Dollar as their medium

of exchange for international trade. This in itself brings even more

inflationary pressures for the dollar, as more and more of them are

repatriated as they are no longer needed for international trade.

Conclusion

We don’t have inflation because of ‘irresponsible politicians’. In fact, if we look at the growth of the money supply since the War and correct it for the extra liquidity created to pay the interest, it was probably about 40%: not even enough to finance extra production through economic growth.

We don’t have inflation because of ‘irresponsible politicians’. In fact, if we look at the growth of the money supply since the War and correct it for the extra liquidity created to pay the interest, it was probably about 40%: not even enough to finance extra production through economic growth.

This sheds a different light on the popular claim that ‘politicians

are debasing the currency’ or on the notion that fiat currencies are per

definition inflated into oblivion.

Prices have been rising not so much because of inflation, but due to rising cost for capital.

This suggests a normally functioning currency board monitoring a

non-interest bearing money supply should be able to manage the money

supply effectively and maintain stable prices.

Currently the situation is more complex: there is a combination of

both inflationary and deflationary pressures. Prices seem to be rising

for food and energy, while assets remain depressed.

It is not rampant printing, but speculation in commodities and

dollars being brought home because they are no longer needed

internationally.

These conflicting trends make the situation obscure and it is

difficult to make real predictions. Hyperinflation seems unlikely for

the time being, but purchasing power will continue to decline for most

people. Assets are declining in value, while the prices for our daily

groceries and fuel and increasing.

Declining purchasing power and economic activity will continue until

the Money Power has achieved its goals or until we find other ways.

----------------------------------------------------

Stagflation explained………at last

This article was published at henrymakow.com

Since the official start of the Credit Crunch in September 2008 a

fierce debate has been raging whether we would be facing deflation or

inflation. We can now establish that we will have a very toxic

combination of both, known as stagflation.

Stagflation is the phenomenon of rising prices while demand in the

economy falls as a result of which production tanks. It was first

experienced in the late seventies and although it eventually

disappeared, there was never given a satisfying explanation for it.

Proponents of both the deflation and inflation hypotheses in the

aforementioned debate had strong arguments. Deflationists would say

the banks were insolvent and would not be able to provide credit,

leading to a diminishing money supply and declining prices.

Inflationists would say Central Banking and Governmental policies of

bail outs, QE1,2,x and stimulus would lead to more money in

circulation, with rising prices as a result.

Both were right, but were missing a crucial key. This key is, that

there are two economies. One is the real economy, where you and I

operate. We work and make stuff. Cars, food, all sorts of services. And

there is also what I would call the financial economy. This is the

shadowy world of finance, FOREX, stock exchanges, commodity exchanges.

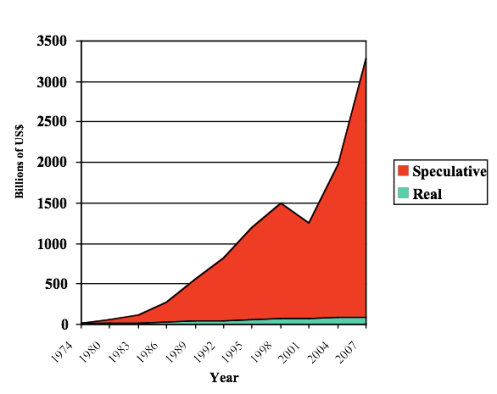

The graph below shows the vast scale of this financial economy, which is

many times bigger than the real economy.

What we see here is the transaction volume for the financial economy

in red and the real economy in green. At this point we are talking about

5 trillion worth of transactions per day in the financial economy,

many times more than in the real economy. We can also see that where the

real economy grows in linear fashion, the financial economy grows

exponentially. The unexpected decline we see around 2000 is explained by

the introduction of the euro, which diminished FOREX speculation. A

small price to pay for that giant leap towards World Currency.

It also shows that the financial sector began to exist in earnest only in the early seventies. This is explained by the rise of the computer. Most people won’t realize that even in the early sixties most wages were paid weekly…..in cash. It is the computer that made it possible for banks to connect everybody to their system. Before then, the administrative load of universally held bank accounts would have been unfeasible. It also explains why stagflation had not been around before the late seventies.

It also shows that the financial sector began to exist in earnest only in the early seventies. This is explained by the rise of the computer. Most people won’t realize that even in the early sixties most wages were paid weekly…..in cash. It is the computer that made it possible for banks to connect everybody to their system. Before then, the administrative load of universally held bank accounts would have been unfeasible. It also explains why stagflation had not been around before the late seventies.

The financial and real economies to some extent interact, primarily

via commodity exchanges. But it is very important that the financial

economy is largely isolated. A lot of the hot money in the financial

economy never reaches the real economy. Thankfully and by design,

otherwise the dollar would not even have that meager 1% of the

purchasing power it had in 1913. This is so, because for instance FOREX

is just an eternal ping pong of transactions within the banking sector,

leading to an eternal wealth transfer from the not so savvy to the usual

suspects.

The above graph and the fact of two parallel economies also explains

why in the last decades price rises were so much lower than the

expansion of credit in that time span would suggest: a lot of the newly

created money was siphoned off to the financial economy.

With this introduction of the concept of the parallel financial and

real economies we can now understand what stagflation is, and why it is

the inevitable outcome of the events of the last two years.

What we have is a deflation in the real economy but a massive

inflation in the financial economy. What is causing stagflation is that a

portion of this hot money is now entering the commodity markets,

leading to semi hyperinflation in the primary sector (agriculture and

mining). These rising prices there must be passed to producers in the

secondary and tertiary sectors (industry and services).

An example of this process were the skyrocketing oil prices in 2009. It has been established that Goldman Sachs was using TAARP funds to drive up prices.

Oil prices are not rising because of ‘Peak Oil’. There is no ‘Peak

Oil’. There is only the old wine in new bags of ‘artificial scarcity’,

which has been the main marketing tool of Big Oil since the days of

Standard Oil. Oil prices exploded because of hot money driving it up,

not because there is a lack of it.

Another example is the current rise in food prices. Or what to think of JPM cornering the copper market?

The deflation in the real economy is caused by the credit crunch, and

transparently and by design exacerbated by the new Capital Reserve

Requirements that were foisted upon the banking system by the Bank of International Settlements.

Corporations, especially those that are not part of the Transnational Cartels that are Big Business, are choked by lack of credit and going out of production, with rising unemployment as a result.

Corporations, especially those that are not part of the Transnational Cartels that are Big Business, are choked by lack of credit and going out of production, with rising unemployment as a result.

It is this combination, deflation in the real economy, strong

inflation in the financial economy leaking out via speculation on the

commodity markets that causes stagflation.

-------------------------------------------------

Dealing with Inflation

Inflation is very much on the minds of people today. With

massive FED handouts to the banking system people fear prices will rise.

Our current predicament is much worse, we’re suffering from stagflation, but inflation is an important part of that.

Like with all monetary matters, many half truths are presented as

facts and downright lies as conventional wisdom. So let’s get to the

bottom of inflation and see what a rational money system can do to

prevent it.

Inflation is a growing money supply.

If the money supply grows faster than production, prices will rise.

But if the money supply grows slower than production, prices will fall.

But if the money supply grows slower than production, prices will fall.

Therefore we can immediately establish that inflation is not the same as rising prices.

An interesting fallacy which many people believe in, is that society

at large can ‘inflate it’s way out of debt’. The idea is, that by

letting prices rise through inflation the nominal value of the debts of

society decrease.

However: in our ‘system’, all money is debt. So if the money supply

grows, the debt grows. The value of the debt in real terms is stable:

the amount of debt grows exactly as quickly as the nominal value

decreases.

So although individual debtors stand to gain from rising prices, indebted society as a whole wins nor loses. The question who wins and loses, is answered by who is taking on the new debt.

So although individual debtors stand to gain from rising prices, indebted society as a whole wins nor loses. The question who wins and loses, is answered by who is taking on the new debt.

The United States Government, for instance, could not ‘inflate its

way out of debt’, because she would be taking on all the new debt (the

inflating money supply) herself.

An important point is, that rising prices through inflation knows clear winners and losers.

The two main losers from inflation are creditors and savers. However,

debtors win. The real value of their debts is declining when prices

rise.

People who have zero net assets lose nor win when prices rise through

inflation. The price of labor (wages) rises along with all other

prices.

It is important to note that at this point the majority of Americans

have zero net assets. These Americans are safe from the results of

inflation (although not from the stagnation that comes along with

stagflation).

Another point we should mention is, that when the money supply is

inflated, those spending the money into circulation gain. Once the new

money starts to circulate and prices rise, the same money will not buy

as much as with the first transaction.

This is one of the strengths of Social Credit, a system where the

Government prints debt free money and hands it out to populace to spend

into circulation. Even if the Government inflates this money supply into

oblivion, the population would be fully compensated because it would

spend the money into circulation herself.

An important benign aspect of inflation and rising prices is that it

spurs economic growth. A well known example is 16th century Europe,

experiencing a long term boom because specie from South America was

flooding the European markets, who had been chronically depressed as a

result of scarce currency.

Another good example is the US in the 19th century, rising to World Supremacy during the inflation of the Continental and the Greenback, while Europe was depressed under a Gold Standard. And let’s not forget the post war boom, that was also a result of easy money combined with rising prices.

Another good example is the US in the 19th century, rising to World Supremacy during the inflation of the Continental and the Greenback, while Europe was depressed under a Gold Standard. And let’s not forget the post war boom, that was also a result of easy money combined with rising prices.

There are two reasons rising prices through inflation helps economic

growth. In the first place businessmen see higher future profits,

because prices are rising. They therefore are more eager to invest.

Secondly, inflation is detrimental to those hoarding cash. They will

spend, rather than hoard it, because tomorrow it will buy less.

Therefore the velocity of money circulation increases, providing even

more net liquidity to the economy as a whole.

Our experience with inflation, therefore, provides good anecdotal

evidence of the proposition that money should be used as a means of

exchange, and not as a store of value.

Inflation is most feared in it’s extreme form: hyperinflation. This

happens when the money supply is inflated so fast, prices rise

dramatically in a very short time span. Wiping out all savings. And thus

wiping out the middle class.

This is destabilizing to society, because as long as the middle

classes as contented, they won’t side with the poor against the

plutocracy. But when they get disowned by their partners in maintaining

the status quo, strange things can happen.

The most famous example of hyperinflation and it’s consequences is

the 1923 Weimar inflation, which was one of the key ingredients of

Hitler’s rise to power ten years later.

Nowadays we have Zimbabwe, where hyperinflation is so bad normal society has difficulty operating.

Nowadays we have Zimbabwe, where hyperinflation is so bad normal society has difficulty operating.

Hyperinflation will be the end of the remnants of the middle class in

the US. Because the middle class is the class that hoards cash. The

poor don’t, they have none to hoard, and billionaires don’t either.

Insiders know when to get out of the paper assets and you don’t become a

billionaire by saving, but through investment.

However, it is useful to observe that the middle class could easily

protect itself from inflation. Just don’t hoard cash or other paper

assets.

So we have established that inflation is dangerous when prices rise

too fast. But we have also seen that far from all within society lose

from inflation. In fact, ‘moderate’ inflation has historically

accompanied long term economic growth, benefiting all.

However, a larger issue needs consideration in our time. More and

more people are wondering whether the FED is trying to create inflation

to spur economic growth, or hyperinflation to destroy the American

Empire so it will accept the New World Order.

Another issue is, that many people believe the iniquities of

inflation outweigh the benefits and they are looking for inflation free

currencies. Many have a full reserve Gold backed currency in mind.

It is indeed becoming clearer day by day that the power to inflate

the money supply in the hands of money masters with hidden agendas,

other than serving the public by optimally managing the system is a very

grave threat. Second only to the continuous massive drain through

interest, manipulating the amount of currency in circulation, leading to

booms and busts is quite a scourge.

The question is, is it possible to create a system that will make it

impossible for the handlers to inflate or deflate the money supply?

Those proposing Gold say that only God can print Gold, so if we use that, we’d be guaranteed of a stable volume of money.

But is this really so?

A full reserve Gold banking industry would still be controlled by the same financiers.

Gold has been a highly strategic commodity for millennia. It is well known that powerful private parties have had a strong stake in this market for most of this time.

For a stable money supply the World’s populace should be absolutely certain where all of the Gold in the World is. Otherwise said parties could stash a substantial part of the Gold in their private vaults, flooding and freezing the Gold market at will.

Gold has been a highly strategic commodity for millennia. It is well known that powerful private parties have had a strong stake in this market for most of this time.

For a stable money supply the World’s populace should be absolutely certain where all of the Gold in the World is. Otherwise said parties could stash a substantial part of the Gold in their private vaults, flooding and freezing the Gold market at will.

This would seem a daunting task, considering the power of the Banking industry and its handlers.

GATA has made quite a reputation for itself in exposing the current

manipulation of the Gold market. Proponents of Gold are looking to the

Government to end this, but this is inconsistent, because most

proponents of Gold have little confidence in Government. Indeed:

allowing the Government such a stake in money creation seems sub optimal

at best.

Does a free market for Gold exist? Is it impossible to manipulate the

flow Gold? These are fairly serious questions that need to be addressed

before we can accept that Gold will indeed provide a stable amount of

currency in circulation.

Another notable aspect is the fact that inflation hurts savers and

creditors is one of those perverse side effects of traditional banking.

They need savers for capitalization. In an interest free credit

environment credit facilities would make all the credit available,

without any reserves. No saving would be required.

A full reserve banking system would still need savers, exposing them to the risks of inflation.

So again: is it possible to devise a monetary system that guarantees the end of inflation?

Probably not. Every system must be controlled and theoretically the

controllers will always be able to find ways to inflate the money

supply.

The problem is, the public does not understand what is happening, and so let the handlers of the system get away with it.

The situation is exacerbated by the fact that money is controlled by

extremely powerful institutions. It is almost impossible to hold them

accountable.

But the fundamental problem is, that people don’t have a choice:

currencies are monopolies, and that’s the heart of the matter. The idea

that banks compete is tenuous at best (their behavior looks more like a

cartel), but it is clear that consumers can only choose for one currency

at this point. There is no free market for currency. As a result of

this they cannot escape abusive currencies.

So to manage the risks of inflation, a three pronged approach is necessary.

1. The education of the public, so that they better understand what is causing inflation and who benefits. This has historically shown to be a daunting task in any subject, the monetary in particular.

2. The individual should protect himself from inflation by not hoarding cash or other paper assets.

3. Monetary systems should be decentralized. There should be more of them, regional currencies for instance. Those managing these systems will be much closer to the public they serve. They will have more to fear from retribution and they will care more for the people they serve and know. But also global internet currencies, who would be kept in check by stringent market forces. Smaller organizations have a better record of morally sustainable behavior.

1. The education of the public, so that they better understand what is causing inflation and who benefits. This has historically shown to be a daunting task in any subject, the monetary in particular.

2. The individual should protect himself from inflation by not hoarding cash or other paper assets.

3. Monetary systems should be decentralized. There should be more of them, regional currencies for instance. Those managing these systems will be much closer to the public they serve. They will have more to fear from retribution and they will care more for the people they serve and know. But also global internet currencies, who would be kept in check by stringent market forces. Smaller organizations have a better record of morally sustainable behavior.

When people have access to several currencies, they will desert the ones being excessively inflated.

We need to get rid of currency monopolies. Currency is far to

important to centralize in the hands of the few. With a network of

currencies, just like with the internet, society can continue to

function when one ‘hub’ fails. In a marketplace with competing

currencies, it would be far more transparent which currencies are

effective, and which are not.

We will explore this crucial subject next time.

------------------------------------------------ Why Gold is so strongly deflationary

‘You

are aware that the gold standard has been the ruin of the States which

adopted it, for it has not been able to satisfy the demands for money,

the more so that we have removed gold from circulation as far as

possible.’

Protocol 20

Protocol 20

One of the key problems with Gold as currency is that it is

strongly deflationary. Austrian Economics both denies deflation is

disastrous and that Gold is deflationary and this is one of its major

weaknesses.

The fact that Gold is strongly deflationary has always been one of the key issues in the debate, even in the late 1800′s.

Populists throughout the 19th and early 20th century have always

fought for more plentiful money. The famous Bryant exclamation ‘you

shall not crucify labor on a cross of Gold’ was not in the context of

debt free money, but to allow Silver to circulate besides Gold. To

improve liquidity and alleviate the scarcity in the means of exchange,

depressing the economy and of course badly hurting debtors.

As mentioned earlier, Keynes wrote ‘the economic consequences of Mr.

Churchill’ when Churchill put Britain back on the Gold Standard in 1925.

Correctly predicting the Great Depression would result from it.

Keynes is of course the arch enemy of Austrian Economics and they

have difficulty maintaining a straight face when discussing him. But

it’s in an inconvenient truth for them that Keynes called this one a priori, while Austrian Economics cannot explain it away even a posteriori.

Austrians nowadays come up with the most amazing arguments to

downplay the fact that the Great Depression was basically a Fed induced

deflation, while on a Gold Standard. Several people have offered me this study by the Fed, ‘proving’ it was not a deflation.

How does this compare with Austrian Economics’ successful exposure of the Fed manipulation of volume of the Money Supply? Does anybody believe anything the Fed says when it comes to volume of the money supply?

Do we really need to discuss Fed studies proving it did not cause the Great Depression?

How does this compare with Austrian Economics’ successful exposure of the Fed manipulation of volume of the Money Supply? Does anybody believe anything the Fed says when it comes to volume of the money supply?

Do we really need to discuss Fed studies proving it did not cause the Great Depression?

Even Bernanke himself admitted ‘we did it’

in the speech that made him famous as Helicopter Ben. Of course we

don’t even believe him when he blatantly speaks truth like that, but

still.

So on the one hand Austrians ‘deny’ the link between Gold and

deflation. On the other hand, they try to downplay its detrimental

effects. They say:’look at what happened to computers and mobile phones.

Declining prices! Great right?’.

But these are examples of breakthrough technologies getting cheaper under market pressures.

Deflation has nothing to do with that. Deflation is a stagnating

economy because demand is plummeting. And why is demand plummeting?

Because the money supply is contracting.

For a practical example of what deflation actually really looks like we currently have Greece. But also the United States itself, with its imploding M3, exacerbated by crashing velocity, and accompanying 20% + unemployment.

American Populists have known for ever that the only ones benefiting

from declining prices are the ultra rich who use their newly found bail

out riches to buy up real assets for pennies on the dollar.

Three Points

1. Populists have always maintained Gold is scarce. Ridiculous, Austrians say. We divide all the money in the world through all the Gold available and thus the right price for Gold can be established.

The problem is, the economy grows, while Gold supplies grow slower.

So the money supply contracts in relative terms compared to the total

amount of transactions.

The Protocols, by the way, are on the side of the Populists:

“The issue of money ought to correspond with the growth of population and thereby children also must absolutely reckoned as consumers of currency from the day of their birth. The revision of issue is material question for the whole world. “

“The issue of money ought to correspond with the growth of population and thereby children also must absolutely reckoned as consumers of currency from the day of their birth. The revision of issue is material question for the whole world. “

This is the most obvious problem. However, there are far more serious issues.

2. The Gold will circulate in the form of credit.

Of course, the Gold in the hands of individuals is debt free. But

once spent, it will quickly reenter the banking system, and it will only

leave it in the form of credit. Thus the money supply will be interest

bearing, just like with today’s Fed notes. Because of that there is

never enough Gold to pay off the debts + interest. People will have to

go into debt to pay the interest and every ounce of Gold will have to be

relent again again and again ad infinitum. Read this article to understand the basic process, "Debt Free Money alone does not solve Compound Interest" [BELOW]

Or read this analysis by Mike Montagne with the basic math behind it all.

What this means is, that through ever higher debt service over the same money supply, less and less liquidity is available to finance real trade.

Or read this analysis by Mike Montagne with the basic math behind it all.

What this means is, that through ever higher debt service over the same money supply, less and less liquidity is available to finance real trade.

This is also happening in our current system. But since that is paper

based, the problem is solved by printing ever more money. And it is

this dynamic that is driving the growing money supply, far more so than

‘irresponsible politicians’.

Under Gold this inflation is impossible. The same trade will have to

be financed with ever less available Gold and this is a major

deflationary trap.

This is only one problem with interest on the money supply, of course, but a very important one.

3. The final issue is that it is completely unknown where all the

Gold is. It’s even an open question how much there is. Gold is tightly

controlled and highly manipulated market and has been cornered by the

Money Power for ever. It is easy for her to take Gold out of

circulation. It’s basically always the same thing: call in loans and

don’t give out new ones. Cite ‘lack of trust’ or ‘need for structural

adjustments’. So Gold, like the current Fed monopoly leaves us wide open

to manipulation of volume.

Once more: ‘Economic crises have been produced by us from the goyim by no other means than the withdrawal of money from circulation’

Conclusion

Deflation is a nightmare.

Deflation is a nightmare.

Gold is deflationary.

Deflation is a curse for Austrians because they have to wriggle and

squirm to put up a brave face about the issue and they know it.

As long as they are rookies who have no other paradigms available

than what they have been fed by the ‘Alternative Media’, it’s hard to

blame them. But when dealing with generously financed think tanks/propaganda outlets who professionally make up excuses and circumvent the issue in the debate, it’s hard to swallow.

There is no need for the inflation vs. deflation dialectic Austrianism provides the Money Power with.

Interest free currencies, produced either by the State or the market

or both, could reflate the economy free of cost, ending the wealth

transfer through interest at the same time.

----------------------------------------------------

Debt Free Money alone does not solve Compound Interest

Debt free money in a full reserve banking system can

still be subverted by the Money Power through Compound Interest. This is

a vital issue for all Debt Free currency activists and theorists. It

also is relevant for Gold and even Bitcoin.

An important model to finance national economies without the Money

Power is debt free currency. It is printed by Government and spent into

circulation. Either by Government itself, a la the Greenback, or by the

People, Social Credit, which is preferable.

The key reason why this method is better than the current ways is

because it allows an interest free money supply: the money in

circulation is not burdened with interest. Considering the fact that

trillions of dollars are now circulating, each costing 5 to 10 cents per

year in debt service, this is a major improvement.

However, there are a few limitations to debt free money. I discussed them here, but there is a crucial problem that merits independent analysis.

As we know, debt free money does not completely eradicate interest.

For credit a banking system is needed and these banks would require

capitalization: deposits by savers that can be lent out. To attract

these deposits, interest is necessary.

The interest payed over credit in this system will continue to be a

wealth transfer to the rich. Because also in this system it will be the

poor who borrow and the rich who lend.

Worse, the risk is very real the Money Power would be able to subvert a debt free money supply.

Consider this:

Compound Interest

Let’s say we implement Social Credit. The Government prints money and the People spend it. The Money Power would open a number of banks on a full reserve basis, all credit backed by deposits.

During the first year it would acquire a fair bit of the new money. They would easily be able to do so: they could sell some of their Gold or other assets. And they would have major income through for instance Big Business. It would use that income for their loan shark operation.

Let’s say we implement Social Credit. The Government prints money and the People spend it. The Money Power would open a number of banks on a full reserve basis, all credit backed by deposits.

During the first year it would acquire a fair bit of the new money. They would easily be able to do so: they could sell some of their Gold or other assets. And they would have major income through for instance Big Business. It would use that income for their loan shark operation.

Let’s say, for argument’s sake, they obtain 10% of it’s supply.

They start lending at say 5%. Of this 5% they use 2% for cost. The

remaining 3% is profit, new capital, new deposits for their banks.

After 1 year of lending they control 13% of the money supply. After two years 16.09%. After three years 19.28.

After 10 years of lending they would control 34 percent and after 20 years 81% of the money supply.

After 1 year of lending they control 13% of the money supply. After two years 16.09%. After three years 19.28.

After 10 years of lending they would control 34 percent and after 20 years 81% of the money supply.

Compound interest in operation.

Of course, the exact numbers are not important here, it’s the process that matters.

Yes, Government could print ever more money, but this would mean

unstable prices. And the idea that the Money Power is still raking in so

much interest is unacceptable.

Solutions

There are two ways of combating this. The first is to combine debt free money with Mutual Credit, preferably in a free market environment.

There are two ways of combating this. The first is to combine debt free money with Mutual Credit, preferably in a free market environment.

The second is approach is known as ‘demurrage’.

Demurrage is interest on holding money instead of credit. It means

that if you have money in your account, you will be paying interest over

it. It was invented by Silvio Gesell. Demurrage is the secret behind the famous ‘Wörgl Freigeld‘.

I recommend everyone not familiar with it to take note of it. It is the

basic model of the German Regional Currencies, that circulate in dozens

of Germany’s towns and cities.

The effect of demurrage is predictable: people start dumping their

cash. The velocity of circulation is massively increased. Wörgl vouchers

circulated up 140 times in the 13 months they were allowed to finance

the local economy. A dollar or euro would typically go round maybe 8 or

10 times.

Because of higher velocity, far less money is required. That’s also a

notable aspect. This explains why it is so useful in a depressed

economy: depressions are caused by scarce capital.

But the key is that people, in order to get rid of their cash, start

paying up front. This has been confirmed in Wörgl, so its not just an

idea. They even pay taxes up front, just to avoid the penalty of holding

cash.

If we pay our supplier up front, we basically give him an interest free loan.

In this way businesses and commonwealths would be able to finance many big projects interest free.

In this way businesses and commonwealths would be able to finance many big projects interest free.

Concluding

Debt free money, especially Social Credit, is vastly superior to our current system. It does have a major limitation: the Money Power, through compound interest, would be able to control the money supply.

Debt free money, especially Social Credit, is vastly superior to our current system. It does have a major limitation: the Money Power, through compound interest, would be able to control the money supply.

This problem exists both under fractional reserve banking and full

reserve banking. It does not matter whether it’s Gold or debt free

money.

Two easy solutions are available: a combination with Mutual Credit, allowing interest free credit, or demurrage.

Perhaps other ways are imaginable.

This shows just how nefarious the implications of interest really

are. It is a good reminder to not stop until we completely get rid of

it.

I’d be interested in any comments, as I believe this is a serious issue.

Afterthought:

This is also discussed in Ellen Brown’s Web of Debt, the chapter on the Goldbugs vs Greenbackers.

--------------------------------------------------- This is also discussed in Ellen Brown’s Web of Debt, the chapter on the Goldbugs vs Greenbackers.

The Inflation vs. Deflation Dialectic

After

decades of inflation and fears of Ben ‘Helicopter’ Bernanke induced

hyperinflation it is probably not surprising that a wearying public is

starting to wonder whether deflation would be the lesser evil.

But not only is deflation (austerity) a disaster, we are being set up to believe it’s the only alternative to rampant inflation.

It is not and it is time we bury this lie before it starts a life of its own.

But not only is deflation (austerity) a disaster, we are being set up to believe it’s the only alternative to rampant inflation.

It is not and it is time we bury this lie before it starts a life of its own.

Let us recap the classic case against deflation, before looking beyond it.

1. Deflation makes money worth more and all the rest worth less.

That includes labor, which is the commodity that most Americans rely on in the marketplace. Deflation is thus a wealth transfer from those that don’t have money to those that do. About 50% of Americans own zero net assets.

It is fair to say that only a very small percentage of Americans will profit from this wealth transfer.

That includes labor, which is the commodity that most Americans rely on in the marketplace. Deflation is thus a wealth transfer from those that don’t have money to those that do. About 50% of Americans own zero net assets.

It is fair to say that only a very small percentage of Americans will profit from this wealth transfer.

2. Deflation makes debts and the interest payed over them worth more.

This is good for creditors. I.e. the banks and the billionaires.

It is very bad for Government, which owes $15 trillion and for the tax payer, who is on the hook for the whole lot.

As we know it is primarily the middle classes that pay taxes.

It is very bad for all other debtors, including those paying off their mortgages.

This is good for creditors. I.e. the banks and the billionaires.

It is very bad for Government, which owes $15 trillion and for the tax payer, who is on the hook for the whole lot.

As we know it is primarily the middle classes that pay taxes.

It is very bad for all other debtors, including those paying off their mortgages.

3. Prices decline because demand is crashing

Of course, declining prices sounds great, right? Well, if they are going down in certain sectors as a result of innovation or market pressures, yes, then we are happy if prices go down.

But if prices go down because demand is crashing, that’s a completely different scenario. Demand is crashing because the money supply is contracting and that is a very serious problem indeed.

Of course, declining prices sounds great, right? Well, if they are going down in certain sectors as a result of innovation or market pressures, yes, then we are happy if prices go down.

But if prices go down because demand is crashing, that’s a completely different scenario. Demand is crashing because the money supply is contracting and that is a very serious problem indeed.

4. Deflation hinders economic growth

The currency is appreciating. That is a good incentive to hoard the stuff, instead of spending it on investments and consumption, which is the real economy.

Inflation has the opposite effect: people dump cash and this supports economic growth. That’s why contractions are usually deflationary, while booms are usually inflationary.

The currency is appreciating. That is a good incentive to hoard the stuff, instead of spending it on investments and consumption, which is the real economy.

Inflation has the opposite effect: people dump cash and this supports economic growth. That’s why contractions are usually deflationary, while booms are usually inflationary.

So deflation has been utterly discredited, not just in theory, but in

practice. Just think of the Great Depression, which was a monetary

contraction. Europe dumped the Gold Standard in the thirties because it

was so deflationary. Keynesianism was a reaction to this deflation.

And, more relevant today, just think of the poor Irish and Greeks.

They know all about deflation and austerity and they don’t seem to

believe it is doing them much good.

Also keep in mind what kind of people are calling for it. The IMF,

the ECB, Brussels, the banking community. Are we really going to listen

to the people who created this mess in the first place?

Just another Hegelian Dialectic

The fact of the matter is: we are being set up for yet another of ‘their’ favorite dialectics: inflation vs deflation.

Or more accurate: deficit spending vs. austerity.

The fact of the matter is: we are being set up for yet another of ‘their’ favorite dialectics: inflation vs deflation.

Or more accurate: deficit spending vs. austerity.

Its synthesis: a wealth transfer to the rich, of course.

The deficit spenders a la Paul Krugman tell us debt is no problem. Austerity’s advocates tell us it is.

The key to understanding all dialectics is to see their hidden common ground. In this case: both discuss debt, but not interest.

And the problem is not debt, it’s interest.

And the problem is not debt, it’s interest.

But that’s a moot point, you say. Where there is debt, there is interest!

Capital will always want a return, it’s unavoidable.

Capital will always want a return, it’s unavoidable.

Really?

After all: we know our money is generated in computers. Banks (or

better: the banking system at large) create all the money we borrow.

Our $200k mortgage, for which we pay $300k in interest over thirty

years, amounting to ten years of wage slavery for the average American,

is created the minute we go into debt.

Nothing is backing the debt. Nobody is losing control over even one dime. Not even temporarily.

We consider this a disgrace, and say we want Gold to end this scandal.

But the real question is:

If the bank creates the money out of nothing for nothing, why am I paying $300k interest on a $200k mortgage?

If the bank creates the money out of nothing for nothing, why am I paying $300k interest on a $200k mortgage?

Why don’t I get it interest free?

We all know the answer to this question, of course.

It is because we are slaves.

The next question is: would I be any happier if I pay this $300k interest for a Gold based mortgage?

The answer is: we would still be slaves.

Not to the printing press, but to those holding Gold. And don’t

believe for a second that those few ounces you may be holding count for

much. Nobody knows where all the Gold is, but it is a sure bet that the

Money Power has a decisive stake in the World’s Reserves. Remember how

they got rich? Lending to Governments while setting them up for wars

against each other? They were not lending paper back then. Real Gold is

what they were offering. And we can rest assured they didn’t dump all

their Gold after Nixon ended Bretton Woods.

Fractional Reserve Banking is a fraud and an incredibly inefficient

way of producing credit. The reason it exists (besides obvious

historical reasons) is to obscure the truth: that we pay $300k for

absolutely nothing. We are being defrauded. Ripped off.

That’s one of the key reasons the bankers want to reinstate Gold:

they have a better excuse for enslaving us with interest. It all sounds

a bit rich to enslave billions of people with simply credit. Just give

‘m some shiny stuff in return. It worked for yesterday’s Natives, so why

not today?

But real money creation is simple and stable. You can find out how it’s done here.

If you have never seen the real costs of interest to society I very strongly suggest you read up here.

Reread it until you get upset. As long as you don’t, you’ve missed the point.

Reread it until you get upset. As long as you don’t, you’ve missed the point.

We can create all the credit that we will ever need at zero cost.

That is the stone cold truth staring us in the face. It’s all we need to

know to transcend the nasty little Inflation vs Deflation dialectic.

It’s all we need to know to get rid of the crooks and end the lie.

The simple fact of the matter is: we can end all interest payments now

and the crunch would be over tomorrow. Nobody would lose a dime. All

debts would be repaid. Only the rich would lose a massive income stream.

But this income is their reward for enslaving us through their printing

press operation. So I think we can explain to them they’ll have to find

a job to replace that income.

Just think of all the purchasing power that would become available in

all the levels of the economy, if consumers and producers are no longer

weighed down with exorbitant interest costs in exchange for computer

entries.

All this may be a little hard to fathom immediately. But rethink this question:

‘If the bank creates the money out of nothing for nothing, why am I paying $300k interest on a $200k mortgage?’

‘If the bank creates the money out of nothing for nothing, why am I paying $300k interest on a $200k mortgage?’

If you don’t have a mortgage, think about this:

‘Why is the Government spending 700 billion per year (the equivalent of a TARP every year) on debt service alone? For money that was printed the minute it was borrowed?’

‘Why is the Government spending 700 billion per year (the equivalent of a TARP every year) on debt service alone? For money that was printed the minute it was borrowed?’

Keep thinking until you get angry, that’s when you’re getting close.

Study a few of the links in this article and things will start to become

clear.

The choice is simple: start paying attention to these questions, or

continue paying interest for nothing to the Money Power for the rest of

your life.

------------------------------------------------------

No comments:

Post a Comment