Vulture Capitalism, Jews — and Hollywood, Part 1

August 1996 Cover of Moment Magazine

Just before Christmas, TOO contributor Andrew Joyce came out with a very courageous and informative account of the damage various Jews have done through their activities at the upper end of the Western economic system in an area often labeled “vulture capitalism.” I will build on Joyce’s insights in this essay with a simple goal in mind: To further expose Jewish practices that enrich them while causing great harm to a huge number of non-Jews. I will do this by repeating many things I have written about already on this site, some of which are now over a dozen years old, which is ancient by Internet standards. Hopefully, my analysis will enlighten new readers or those just catching on to the Jewish Question. Most hopefully, my examples will allow TOO readers to spread this message to the masses of non-Jews thus far ignorant of the grave threats in our midst. And I will do this through the painless way of using Hollywood hit films to show how Jews hide their economic malfeasance right in plain sight.

After all, what can be plainer than Hollywood blockbusters starring the likes of George Clooney, Julia Roberts, Leonardo DiCaprio, John Travolta, Brad Pitt, Richard Gere, Susan Sarandon, Tim Roth, Jeremy Irons, Kevin Spacey, Danny DeVito, Gregory Peck, Ryan Gosling, Christian Bale and Steve Carell? All of these stars have been pawns brought in to conceal the facts about massive Jewish involvement in Wall Street finance — including immense malfeasance and endless instances of shady practices. Not only does Hollywood conceal these facts, it also projects them onto innocent Whites. And the tactic appears to work, which is why we TOO writers can never rest.

Joyce in his article aims to describe the “scavenging and parasitic nature” of these Jewish practices, labeling them “vulture funds” practicing “vulture capitalism,” thus explaining the essay’s title and use of a photo of a vulture:

Vulture Capitalism is Jewish Capitalism (December 18, 2019)

As good as Joyce’s metaphor is, however, there is a competing one: the vampire sucking the lifeblood out of all it touches. Recall that course on Marxism you may have taken in the 1970s or 80s, where Marx wrote in Volume I, Ch. 10 of Capital that “Capital is dead labour, that, vampire-like, only lives by sucking living labour, and lives the more, the more labour it sucks.”

The first thing you need to know about Goldman Sachs is that it’s everywhere. The world’s most powerful investment bank is a great vampire squid wrapped around the face of humanity, relentlessly jamming its blood funnel into anything that smells like money.Damn, I love that quote.

It’s justified, too, just like Joyce’s use of the term “vulture capitalism.” See how Joyce does not mince words here:

That’s because it’s Jewish enterprise — exploitative, inorganic, and attached to socio-political goals that have nothing to do with individual freedom and private property. This might not be the free enterprise [Tucker] Carlson learned about, but it’s clearly the free enterprise Jews learn about — as illustrated in their extraordinary over-representation in all forms of financial exploitation and white collar crime. The Talmud, whether actively studied or culturally absorbed, is their code of ethics and their curriculum in regards to fraud, fraudulent bankruptcy, embezzlement, usury, and financial exploitation. Vulture capitalism is Jewish capitalism.This issue of Jewish economic power mixed with morally questionable practices in gaining immense wealth has been an enduring theme I’ve written about for TOO, so I will use the present essay to resurrect some of my older writing likely long since forgotten. While I will add to the valuable information Joyce shared with us last December, as well as the follow-up article by “John Q. Publius” called Hedging their Bets (Who Really Decides Elections), where he notes that “Jewish hedge fund managers and plutocrats decide under what guise the neo-liberal machine will continue to operate, for it is in fact all window dressing,” my primary contribution will be to show how Jews in Hollywood create a deceitful medley of films that prevents the mass of goyim from ever connecting Jews to financial manipulation and theft.

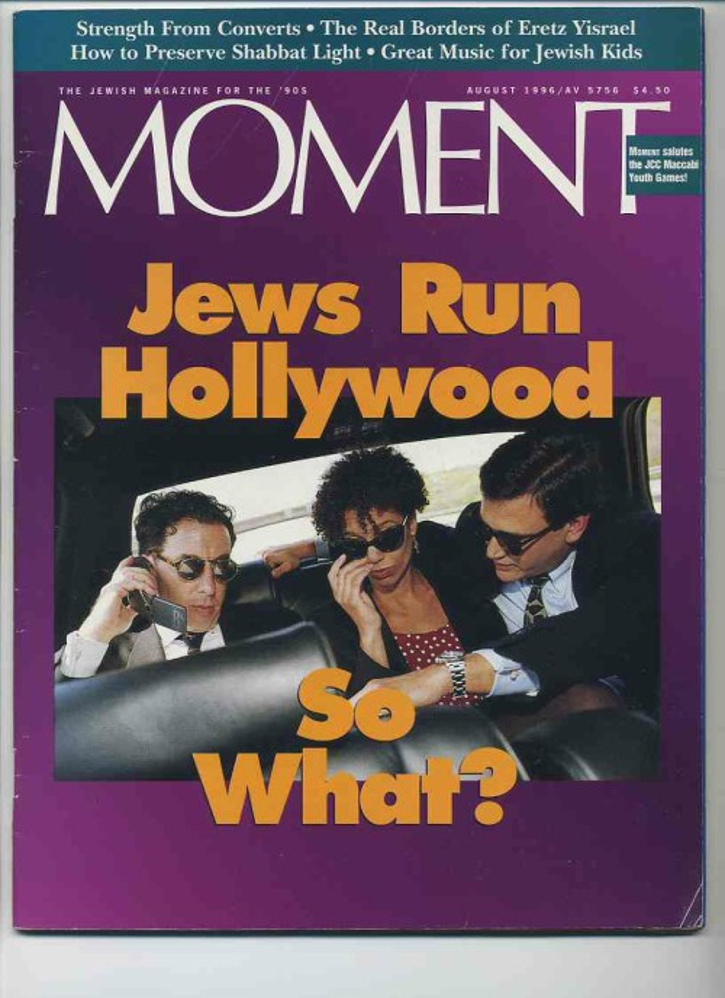

In short, I aim to answer part of the question posed in the purple cover story posted above following the main title “Jews Run Hollywood.” The question I will work on is “So What?” The short answer is that in fact it matters a lot that Jews run Hollywood, from promoting diversity and holocaust guilt—subjects for another time, to erecting a mask that hides Jewish involvement in financial crime. Our task is to get behind the mask.

The Money Films

Wall Street.

Although I haven’t reviewed it previously, I’ll start with Oliver Stone’s 1987 Wall Street, where (half-Jewish) director Stone was at pains to avoid portraying any of the leading characters as Jewish, despite the fact that the 1980s were famous for the rise of Jewish financiers on both sides of legality — Boesky, Milken, et al. The first book to read on this subject is Connie Bruck’s The Predators’ Ball: The Inside Story of Drexel Burnham and the Rise of the Junk Bond Traders. The book is a convincing account of Jewish financial mischief — that it is pervasive and has a massively negative effect on the greater non-Jewish world.

An even better book is James B. Stewart’s Den of Thieves, in which Stewart chronicles the misdeeds of Ivan Boesky, Martin Siegel, Dennis Levine (who wrote his own book, Inside Out: The Dennis Levine Story), and most of all, Michael Milken, the mastermind behind it all. Simply by describing all the Jews involved, Stewart makes it clear that it was a cabal of Jews that pillaged and destroyed some of the most well-known corporations in America at the time by inventing and peddling “junk bonds” as an “advance in capitalism” which enabled hostile takeovers of corporations while typically saddling them with huge debt and enriching themselves. A must-have book. (Intriguingly, the obituary of Stewart’s mother notes that her son James’ “spouse” is one Benjamin Weil, who is Jewish.)

Predictably, Den of Thieves was attacked as “anti-Semitic.” Jewish activist Alan Dershowitz called Den of Thieves an “anti-Semitic screed” and attacked a review by Michael M. Thomas in the New York Times Book Review because of his “gratuitous descriptions by religious stereotypes.” Thomas’s review contained the following passage:

James B. Stewart . . . charts the way through a virtual solar system of peculation, past planets large and small, from a metaphorical Mercury representing the penny-ante takings of Dennis B. Levine’s small fry, past the middling ($10 million in inside-trading profits) Mars of Mr. Levine himself, along the multiple rings of Saturn — Ivan F. Boesky, his confederate Martin A. Siegel of Kidder, Peabody, and Mr. Siegel’s confederate Robert Freeman of Goldman, Sachs — and finally back to great Jupiter: Michael R. Milken, the greedy billion-dollar junk-bond kingdom in which some of the nation’s greatest names in industry and finance would find themselves entrapped and corrupted.Thomas was attacked as an anti-Semite simply for mentioning so many Jewish names all in one paragraph. His defense was to note that “If I point out that nine out of 10 people involved in street crimes are black, that’s an interesting sociological observation. If I point out that nine out of 10 people involved in securities indictments are Jewish, that is an anti-Semitic slur. I cannot sort out the difference.”

Other People’s Money.

While not the first film I parsed regarding Jews and money, Other People’s Money, released in 1991, follows most closely the famous 1987 film Wall Street. The former film stars Gregory Peck in his last major performance, pitted against Danny DeVito as the peripatetic Wall Street takeover artist Lawrence Garfield. As I showed in my review, the movie is fully cleansed of Jewish identity, instead giving us the diminutive Italian-American DeVito outsmarting the more WASPy figure played by Peck.

Remarkably, this thirty-year-old film represents the exact same topic that Andrew Joyce started with in his Vulture Capitalism essay where he cited a recent Tucker Carlson segment called “Hedge Funds Are Destroying Rural America.” Joyce’s link to this segment describes it:

Tucker Carlson is perhaps the only major media figure in America willing to attack across party lines to make his point. On Tuesday night he went after Republican mega-donor Paul Singer in a withering 10-minute special segment on how Singer destroyed a small town in Nebraska in a hostile takeover of the sporting goods retailer Cabela’s.

Now watch the opening of Other People’s Money, with DeVito’s stark “I Love Money” soliloquy. Which ethnic stereotype does that fit? (Hint: think of Shakespeare’s The Merchant of Venice, whose main character’s name starts with “Sh” and rhymes with “High Rock.”)

The genesis of Other People’s Money is important, for it began as a play of the same name by Bronx-born Jerry Sterner. The original play’s protagonist, “a Jewish corporate takeover artist, was named Larry Garfinkle, not Garfield.” And stage actor Kevin Conway played him as a very Jewish character, to the point that “some critics and audiences … found Conway’s performance to be larger-than-life — uncomfortably so. Some reviewers called Conway’s Garfinkle a Wall Street Jackie Mason — a performance more akin to stand-up comedy than straight theater, one that emphasized the character’s ethnicity and loaded Sterner’s play with potentially anti-Semitic ‘Merchant of Venice’ overtones.”

Sterner worried about this, as he related in an interview with the New York Times, saying “I did not want the play to become controversial about what it is not about. It’s not about Garfinkle’s being Jewish, it’s about his doing good or not.” Because of his discomfort with Conway’s portrayal of the explicitly Jewish Garfinkle, Sterner added a “cautionary postscript” to the play’s published text: “The character of Garfinkle can be played in many ways. The one way he should not be played is overly, coarsely, ‘ethnic.’”

Even with this controversy, when the play moved to Hollywood, the script retained the name Larry Garfinkle, but it was crossed out and changed to “Garfield.” Director Normal Jewison (by most sources, not Jewish) admitted that he changed it. “It’s not important that Larry Garfinkle is Jewish. Boone Pickens isn’t Jewish. Jimmy Goldsmith is, as are nine out of the 12 top corporate raiders in America, but there are three others that aren’t. What does it matter, anyway? This isn’t about religion.”

Yeah, what does it matter? (Sigh)

In short, here’s the message: Jorgenson (played by Peck) and his family are the old America, captured nicely in a touching recreation of Norman Rockwell’s Thanksgiving Day feast. But the sad reality is that Jorgenson loses his factory, the workers are thrown out of work, and the man who loves money has won. Clearly, the impression is that White America has become a very different place, a place led by those like Larry Garfield — or Paul Singer, as in Tucker Carlson’s updated account from small-town Nebraska.

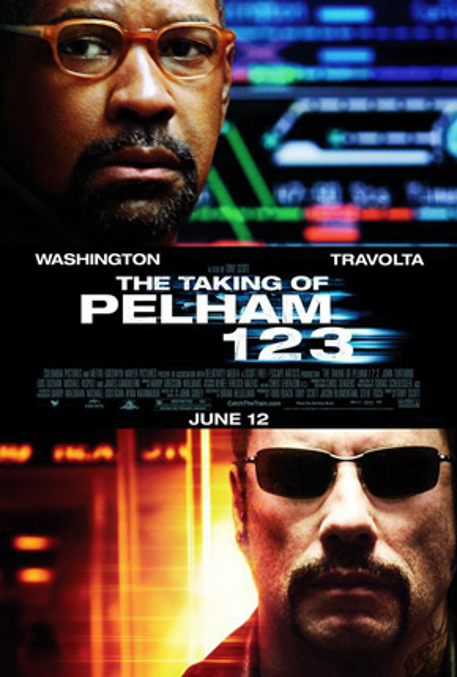

The Taking of Pelham 123.

Jump ahead to the year 2009 and we find a remake of The Taking of Pelham 123, featuring the “Always-Better-Than-Whites” Denzel Washington up against John Travolta as a Wall Street mastermind who has first committed massive fraud, then gone insane.

In this version, Travolta’s character is a New York ethnic Catholic very prone to guilt. He was also a high-rolling Wall Streeter who skimmed millions of dollars until he was caught and sent to prison. Upon his release, he concocts a scheme to make a killing on stocks when he induces panic in the city with a subway hijacking. Return to James Stewart’s account of the 1980s savings and loan swindles in Den of Thieves and you’ll find out that the thieves were ethnic New Yorkers all right, but they sure weren’t Catholic. Clearly, this deceit is part of a concerted media effort to blame others for Jewish (mega) misdeeds.

Just to crosspollinate, the Tribe that year called on Israel-born Hanna Rosin to fill out a cover story for the December 2009 Atlantic Monthly. Coming a year after mind-boggling economic swindles and bailouts that used up a significant portion of the universe’s zeroes, who gets blamed? Christians. Now that’s why Jews are so often credited with chutzpah.

Margin Call.

Two years later, we come to the film Margin Call, starring Kevin Spacey and Jeremy Irons. J.C. Chandor’s 2011 film tells a story that loosely mirrors the fall of Wall Street giant Lehman Brothers. Even for Hollywood, however, the deception in this movie is staggering, and it occurs on many levels. It terrifies me to think that the masses likely swallowed this tale, particularly the images that have such a powerful subliminal impact.

Now picture this: The Margin Call premise is that a group of WASPs and a Catholic or two run a leading investment bank on Wall Street. Things turn sour, however, and the firm is looking at bankruptcy unless they can pull off a miracle.

Obviously, such a scenario makes little real-world sense. In the real world, Wall Street is heavily Jewish, especially the investment banks. This is so obvious that Wiki has a special segment called Jewish investment banks.

Lehman Brothers was a classic Jewish investment bank. For those wishing to find more explicit discussion about the Jewish origins and uninterrupted Jewish roots of Lehman Brothers, see the following indispensable books:

- Stephen Birmingham: Our Crowd: The Great Jewish Families of New York(Harper and Row, 1967) and The Rest of Us: The Rise of America’s Eastern European Jews (Little, Brown & Company, 1984);

- Jean Baer’s The Self-Chosen: “Our Crowd” is Dead — Long Live Our Crowd(Arbor House, 1982);

- Richard L. Zweigenhaft and G. William Domhoff’s, Jews in the Protestant Establishment(Praeger Publishers, 1982);

- Gerald Krefetz, Jews and Money: The Myths and the Reality(Ticknor and Fields, 1982).

Margin Call sure was a deception sandwich. The head of the trading floor, Sam Rogers, is played by Kevin Spacey, who looks, acts and talks exactly like the middle-class White man he played in American Beauty. In Margin Call there is not even an attempt to give him a Brooklyn accent or exaggerated mannerisms.

Kevin Spacey in Margin Call

Most egregiously, however, is the fact that the part of Lehman Bros. CEO is played by none other than the arch-British actor Jeremy Irons.

Jeremy Irons as the CEO of Lehman Bros.

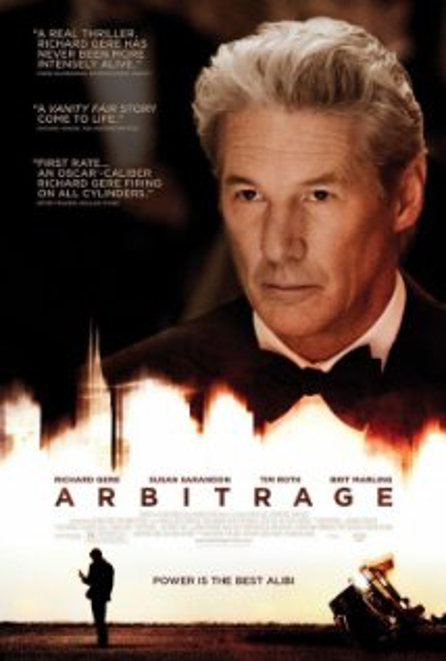

Arbitrage.

A year later, the lying continued as Richard Gere starred opposite aging beauty Susan Sarandon and Tim Roth in Arbitrage. Gere plays a Wall Street character quite willing to bend and break all kinds of rules. As in the other Wall Street films just mentioned, the mission of Arbitrage is to mask the Jew and project the blame onto gentiles. It really is breathtaking.

The film’s opening solidly sets up the identity of Robert Miller (Gere) and his clan as thoroughly White and Christian. In an interview, millionaire Miller attributes his innate pessimism about events to his parents, who had grown up with the Depression, Pearl Harbor and The Bomb. His everyman Christian American background is confirmed by a comment that his father was a welder in the Navy and his mother worked for the Veteran’s Administration.

Soon after, he returns home to a surprise birthday party, where he is surrounded by a large extended family. His wife, played by Sarandon, is clearly European-American, as is his daughter Brooke and each and every child running about the room. There is not one hint that Miller, his family, or anything in his home could be anything other than gentile American.

Soon Miller gets himself in trouble and ends up short of cash, so he manipulates $412 million to paper things over. Along the way he also gets his mistress killed and burned to a crisp when he crashes a car after a few drinks. (Naturally, he flees the scene and tries to pin it on a young African American; those rich WASPs are really horrible people.)

The finale of the film lays it on thick: Rich gentiles are thoroughly corrupt when it comes to money. In the last fifteen minutes, we see how Miller is able to deviously escape the suspicions about him, even though his wife has connected the dots and figured out how guilty her husband is. Crushed by his infidelity and the suffering he has put their daughter Brooke through, she responds — by coldly blackmailing him. Either he coughs up a significant sum of money for her favorite charity, or she divorces him and walks away with perhaps far more.

Next, we cut to a scene with the man who bought Miller’s firm, James Mayfield (who may as well have been named James Mayflower, given his mien and surroundings), who is shown riding in his limousine to the “Benefit Gala in honor of The Miller Oncology Center.” He then exits the limo and ascends the stairs to the goy gala — the entire affair is sheer goy hypocrisy. The money for the new center is tainted, and everyone in attendance pretends that everything is honorable. Miller is all smiles, his wife smiles, even his disillusioned daughter goes along, cynically but without conviction feting her father: “A dedicated businessman, a family man, a philanthropist, and an all-around humanitarian. A man I am very lucky to call my mentor, my friend, and my father.” The message: behind America’s most sterling institutions and leaders lie deceit and insincerity — gentile deceit and insincerity, of course.

The reality, we know, is different, as TOO writers Joyce et al. have shown, along with others. Former Counter-Currents writer Andrew Hamilton, for instance, showed four years ago what real hedge fund managers were doing and who they were:

More often than not the privileged Jews turn around and use [their] vast wealth … to advance anti-White, pro-Jewish, and Left-wing causes, thereby harming America and the world in two ways — economically through callous and shortsighted market operations, and politically through their “philanthropy” and lavish political donations. George Soros has done enormous harm to Whites worldwide in this manner. . . .Hamilton specifically notes the shocking wealth concentrated in such hands, referring to Forbes Magazine’s recent ranking of the richest hedge fund managers in the United States by estimated personal net worth: “Twenty-four of the 32 names on the list (75%) are Jewish. Of the 10 wealthiest, 8 (80%) are Jewish.” He further adds that “Despite their social and economic power and privilege the names of hedge fund managers are virtually unknown even to educated and informed people, never mind the general public.” In good part, we can thank Hollywood for this.

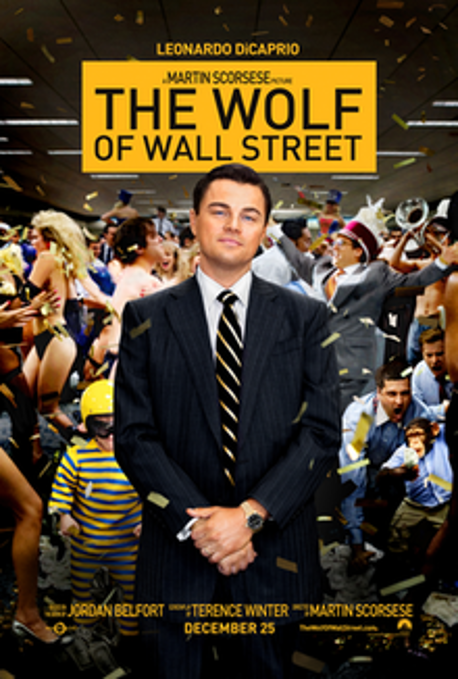

The Wolf of Wall Street.

Thus far, I’ve been a good sport about reviewing these deceptive Wall Street films, but 2013 saw a blockbuster that left me speechless. Here was a film with one of Hollywood’s biggest goy actors, directed by one of Hollywood’s top maker of Mafia films, and based on the autobiography of a convicted Jewish Wall Street swindler who positively reveled in his Jewish identity and that of his cohorts. Yet the film completed whitewashed this.

Here’s the howler: As the bantam Jewish stock fraudster Jordan Belfort, director Martin Scorsese chose none other than six-foot-tall, (sometimes) blond-haired Leonardo DiCaprio to bleach the story of anything Semitic. This has to go down as one of the most egregious miscastings in Hollywood history.

Why did it happen?

My view is that this is a classic case of Hollywood deceiving the public, and I have plenty of evidence for this.

In the film, at exactly five minutes into the story — just after DiCaprio’s character has snorted cocaine with a hundred dollar bill and done a little trick by making us think “this shit” (cocaine) will make you invincible, when it fact he means the money he is using as a straw — he launches into a speech as he enters his busy trading floor:

See, money doesn’t just buy you a better life — better food, better cars, better pussy — it also makes you a better person. You can give generously to the church, or political party of your choice. Save the fuckin’ spotted owl with money (italics added).“To the church.” I like that. In his memoir from which the film springs, Belfort is refreshingly forthright that he is Jewish — and that, with one exception, all of his close associates are Jewish — as are the majority of his traders. Now in the film — which “happened” to open on Christmas Day 2013 — we are informed that rich people like DiCaprio’s Belfort can give “to the church,” not synagogue or ADL or a Jewish think tank. It is this kind of subtle deception that would, in my view, prevent the vast, vast majority of Gentile viewers from understanding that these financial criminals are Jewish at all.

Back in 2007, the convicted trader Jordan Belfort released his autobiography that engendered the later film. In this book, The Wolf of Wall Street, Jewish themes are front and center, beginning with the conflation of Jews and money. Belfort founded the trading firm of Stratton Oakmont (a very British-sounding name) and went on to amass a fortune. His descriptions of his escapades spending that money are hilarious, along the lines of Hunter S. Thompson in Fear and Loathing in Las Vegas. I honestly loved Belfort’s book.

Lust for the “shiksa goddess” is another main theme, as Belfort is absolutely smitten with the gentile woman he manages to marry. If one wants an initiation into Jewish attitudes toward ethnicity, Jewish and otherwise, this is the book to start with. The real fascination surrounding Jewish characters comes with Belfort’s descriptions of his comrades, beginning with his right-hand man, Danny Porush. Danny, Belfort begins, “was a Jew of the ultrasavage variety.” With “steel-blue eyes,” Porush did not appear to be “a member of the Tribe,” a situation Porush himself helped along by dressing and acting like a Gentile. Like many other Jews, “Danny burned with the secret desire to be mistaken for a WASP and did everything possible to cloak himself in complete and utter WASPiness.”

Stratton Oakmont’s head of the finance department, Andy Greene, however, would never pass as a WASP, beginning with the fact that he had “the worst toupee this side of the Iron Curtain.” To Belfort, Greene’s toupee “looked like someone had taken a withered donkey’s tail and slapped it onto his egg-shaped Jewish skull, poured shellac over it, stuck a cereal bowl over the shellac, and then placed a twenty-pound plate of depleted uranium over the cereal bowl and let it sit for a while.”

When discussing another Greene who worked for him — this time Kenny “the Blockhead” Greene — Belfort describes Greene’s mother Gladys: “Starting from the very top of her crown, where a beehive of pineapple blond hair rose up a good six inches above her broad Jewish skull, and all the way down to the thick callused balls of her size-twelve feet, Gladys Greene was big.”

She was also quite willing to break the law, beginning with evasion of taxes on the cigarettes she and the adolescent Kenny smuggled into New Jersey. When Kenny turned fifteen and began smoking pot, his mother immediately became a pot dealer, providing her son “with finance, encouragement, a safe haven to ply his trade, and, of course protection, which was her specialty.” And because cocaine “offered too high a profit margin for ardent capitalists like Gladys and the Blockhead to resist,” they were soon enough plying that trade on Long Island, too.

One gets the feeling that for Belfort, the descriptor “savage” has a redeeming quality to it, as he describes many Jews that way, such as “the most savage young Jews anywhere on Long Island,” those from the towns of Jericho and Syosset. Then there is the Wall Street legend, J. Morton Davis, “a savage Jew,” and even Belfort himself, “the most savage Jew of all.” And don’t forget the “Quaalude-addicted, potbellied savage Jew with a thousand-watt social smile and a secret life’s mission to be mistaken for a WASP” who ripped Belfort off when selling him horses. Belfort’s book unashamedly celebrates Jews.

The film, however, cannot be more different, for reasons stated above. I positively scoured this film and found next to nothing — and it’s nearly a three-hour film. Here’s about all I could find: When one character demands that another come pick up millions in elicit earnings, the latter is insulted and says “I’m not fuckin’ schvartze.” How many caught that one?

One more example that will surely crop up concerns Belfort’s father Max — and the character who plays him, Rob Reiner. In this case, it again comes down to insider/outsider interpretations. Those who know that Reiner is himself Jewish and know that the real Belfort is Jewish will get it. Others, probably not. Back in the early ‘70s, did American viewers see “All In the Family” character Michael “Meathead” Stivic as Jewish? Same actor. Same ethnic undermining without the goyim knowing about it, either.

====================

Vulture Capitalism, Jews — and Hollywood, Part 2

The Big Short.

Did things get any better in 2015 when the star-studded film The Big Short came out? Definitely not. Here we had Brad Pitt, Steve Carell, Christian Bale and Ryan Gosling — goys to a man — acting out the script of the book of the same name by best-selling author Michael Lewis (Moneyball, The Blind Side). And that script would be about how the subprime mortgage industry was slated for a big fall, with our main characters devising ways to place bets on such a fall. To them, there was a serious housing bubble and they meant to

collect when the collapse of the bubble came.

Ryan Gosling

This time, however, Hollywood alone cannot be faulted for seriously downplaying Jewish identity because gentile author Lewis already did that for them, thank you very much.

I had high hopes for Lewis’s book revolving around Jewish identity and was encouraged when I read the second sentence of Chapter One: “[Steve Eisman had] grown up in New York City, gone to yeshiva schools, graduated from the University of Pennsylvania magna cum laude, and then with honors from Harvard Law School.” Yes, I thought, this book was going to openly discuss Jewish identity on Wall Street.

A few pages later, Lewis describes Eisman’s wife and her mother talking about the United Jewish Appeal, as well as how the young Eisman studied the Talmud to find its internal inconsistencies, so I thought we might have a Jewish tale on par with Jordan Belfort’s The Wolf of Wall Street. Alas, that was the last we heard of anything explicitly related to Jews or Jewishness. What a pity, since the subprime mortgage bond collapse was in fact an intensely Jewish affair.

We could have read about Lloyd Blankfein of Goldman Sachs, Maurice “Hank” Greenberg of AIG, Sandy Weill of Citigroup, Dick Fuld of bankrupt Lehman Brothers, or Alan Schwartz of the failed Bear Sterns—and many, many other Jewish players on Wall Street. Most remarkably, we read nary a word on the real powers in finance, people like those “The Three Apostles,” Fed Chairman Alan Greenspan, Treasury Secretary Robert Rubin or his successor Larry Summers. Nor do we read more than passing reference to two-term Fed Chair Ben Bernanke, who oversaw the entire life of the subprime mortgage fiasco, serving from 2006 to 2014.

Worse, we never read about the larger narrative surrounding the financial crisis of those years. (This review of then Treasury Secretary Hank Paulson’s account of the crisis gives a suitable feel for how tremendously dangerous the period was.)

In The Big Short, Lewis follows previously mentioned Steve Eisman, as well as a gentile California neurologist-turned hedge fund manager, Michael Burry. Also featured in the book is Greg Lippmann, head subprime manager at Deutsche Bank, but Lewis never once refers to Lippmann as Jewish. This just isn’t the story Lewis wants to tell, so it’s no surprise that Hollywood screenwriters also left out this important Jewish angle.

Turning now to the 2015 film version of The Big Short, we see that director and co-screenwriter Adam McKay, who is married to the Jewish Shira Piven, does, to his credit, faithfully show the scene where the young Eisman is in a synagogue with his rabbi. But my feeling is that this is done so much in passing that it will be lost on most gentile viewers. More to the point, however, is that actor Steve Carell simply doesn’t come across in any way as Jewish.

Steve Carell should have been Jewish

Now that we’ve looked at visual issues and identity in The Big Short, let’s consider some of the big dollar figures at stake. “Million” hardly has meaning in the debacle, with “billion” being a far more common term (and “trillion” popping up now and again). Despite the impression readers and viewers might have, the four main characters featured in book and movie were hardly the biggest players in the subprime mortgage game, though neurologist Michael Burry certainly did well, as this excerpt from a Vanity Fair article Lewis did in March 2010 shows:

It was precisely the moment he had told his investors, back in the summer of 2005, that they only needed to wait for. Crappy mortgages worth nearly $400 billion were resetting from their teaser rates to new, higher rates. By the end of July his marks were moving rapidly in his favor — and he was reading about the genius of people like John Paulson, who had come to the trade a year after he had. The Bloomberg News service ran an article about the few people who appeared to have seen the catastrophe coming. Only one worked as a bond trader inside a big Wall Street firm: a formerly obscure asset-backed-bond trader at Deutsche Bank named Greg Lippmann. The investor most conspicuously absent from the Bloomberg News article — one who had made $100 million for himself and $725 million for his investors — sat alone in his office, in Cupertino, California. By June 30, 2008, any investor who had stuck with Scion Capital from its beginning, on November 1, 2000, had a gain, after fees and expenses, of 489.34 percent. (The gross gain of the fund had been 726 percent.) Over the same period the S&P 500 returned just a bit more than 2 percent.A far bigger winner was John Paulson, who appears briefly in the article, having spoken to Lewis for the book. Personally, what I’d like to have read about is Paulson’s bets on subprime mortgages. While Burry made just shy of a billion dollars, Paulson made history by earning $4 billion for himself in 2007, followed by $5 billion three years later. “Paulson, bucking the trends and the advice of other investors, gambled that the mortgage market would collapse. His bet paid off immensely. In 2007, the funds run by Paulson were up $15 billion — a staggering investment return rate of nearly 600%.” Of course, for career reasons, I can see why Lewis didn’t dwell on Paulson in the book, and naturally Hollywood was happy to let it go unmentioned.

Paulson’s mother was Jewish, and Paulson has worked in a highly Jewish milieu during his education and career, beginning with a Sidney Weinberg/Goldman Sachs scholarship. Later, he worked with Leon Levy at Odyssey Partners, then moved to Bear Stearns. His older sister, Theodora Bar-El, is an Israeli biologist. Perhaps I should read Gregory Zuckerman’s 2009 book The Greatest Trade Ever: The Behind-the-Scenes Story of How John Paulson Defied Wall Street and Made Financial History to fill in the missing gaps in this story. (And as far as I know, Hollywood has yet to make a film from Zuckerman’s book.)

Zooming out, we read in The Big Short that in total, according to an IMF estimation, about $1 trillion dollars was lost due to the subprime crisis. (Oddly, at the end of the film, we read: “When the dust settled from the collapse, 5 trillion dollars in pension money, real estate value, 401k, savings, and bonds had disappeared.” I can’t account for this large discrepancy.)

Let’s stick with the IMF’s estimate of $1 trillion. That’s a lot of billions in there, far, far more than Paulson’s money alone. So where did the money go? More to the point, who is responsible? Lewis allows his characters to blame stupid investment banks, but others point directly to those in charge of America’s finances: “The Three (Jewish) Apostles — Greenspan, Rubin, and Summers,” as well as Greenspan’s successor, Bernanke.

Time Magazine’s Entry in the “Most Ironic Story of the Year” Category

Just as when you throw a rock in the air at a Wall Street soiree you’ll almost certainly hit someone guilty, one can turn to practically any source on Greenspan et al.’s roles and find many suspicious characters. For instance, let’s consider this unlikely source for suspicion about what The Three Apostles and other high-placed Jews were up to — Clyde Prestowitz’s 2010 The Betrayal of American Prosperity. Here, Prestowitz notes how in 1989 and 1993, financial instruments that later played a central role in the meltdown of 2008–9 were exempted from government oversight. For instance, Greenspan was adamant about getting the government out of the way. “In fact, Greenspan largely halted the Fed’s active oversight of the banking industry.” Joined by Treasury Secretary Robert Rubin and subsequent Treasury Secretary Lawrence Summers, “the three mounted an aggressive campaign to halt any efforts to regulate trading of new derivative instruments.”

When measures to impose constraints on these risky trades were being considered, Greenspan, Rubin, and Summers pointedly blocked them. Also, when Brooksley Born, Chairwoman of the Commodity Futures Trading Commission, attempted to do her job, Summers aggressively attacked her actions. Right on cue, Greenspan, Rubin and Arthur Levitt of the Securities and Exchange Commission pressured Congress to straightjacket Born. (I thought of the beleaguered Ms. Born when in the film version of The Big Short, Georgia Hale, an employee at Standard & Poor’s Financial Services, was grilled by a visiting Mark Baum [Steve Eisman].)

This bullying of Born persisted into 2000, as Greenspan continued to insist that Wall Street should be trusted and left to its own devices. “With those assurances, Congress went ahead and stripped the CFTC of responsibility for derivatives, and President Clinton signed the bill into law in December 2000.” Meanwhile, Ms. Born quietly left government service.

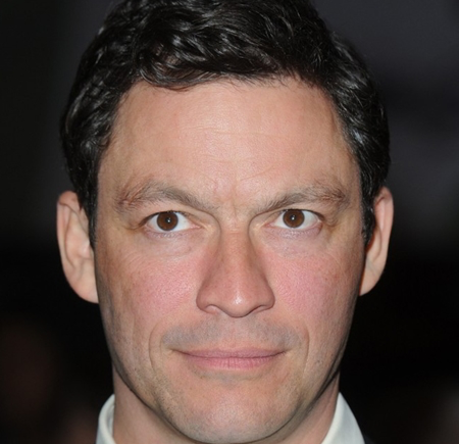

Money Monster.

The last money movie I dissected was Money Monster (2016), starring two more big names: George Clooney and Julia Roberts. Clooney plays Lee Gates, the slick and jaded host of a TV financial advice show of the same name. Gates plugs a company which mysteriously loses $800 million, and many investors are ruined — including one who arrives at the studio and takes Gates hostage with an explosive vest.

The hostage taker is one Kyle Budwell (played by Anglo-Irish actor Jack O’Connell). Budwell is mentally challenged, as shown by his speech and childish behavior. For example, when his mother died and left him $60,000, he invested the whole amount in a company named IBIS, after Gates on a previous show highly recommended the stock. Budwell aims for revenge against Gates for his poor advice and against the CEO of IBIS, Walt Camby.

In the film people are busy behind the scenes finding out where corrupt CEO Camby is. It turns out that he made a secret trip to South Africa to advance his scheme to temporarily employ $800 million from his company to make a killing on a certain mining stock. The deal, unfortunately, falls through and the money is gone. This is then blamed on a “computer glitch” linked to sophisticated trading algorithms, but terrorist Budwell isn’t buying it. For that matter, Grant is becoming suspicious, as well as the head of PR at IBIS.

Emotions evolve. Even though enraged swindled invester Kyle Budwell has laced Grant with an explosive necklace, Grant has begun to feel growing sympathy for Budwell, and eventually we learn of another huge financial crime committed by the fictitious CEO Walt Camby. But of course, if you are going to have a financial criminal, he will have to be cast as not possibly Jewish. Wikipedia informs us that Dominic West, who plays CEO Camby, “was … the sixth of seven siblings … in a Roman Catholic family, largely of Irish descent.” So Jewish he ain’t.

Dominic West

Still, despite its obvious deception, Money Monster is instructive in a way. For those who understand which group is really culpable, a soliloquy by Budwell explains some of that group’s offenses:

I want everyone to know something. I might be the one with the gun here, but I’m not the real criminal. It’s people like these guys! [pointing to Grant and the set crew]. They’re stealing everything from us and they’re getting away with it, too. Nobody’s asking how. Nobody’s asking why.That is very good: “Not the Muslims. Not the Chinese. Them.” Ah, yes. Budwell is blaming people like Grant, CEO Camby and those like them. But if you replace “they” and “them” with “Jews,” his speech is instructive indeed. Is it rigged? Well, anyone reading accounts of the trading patterns of Goldman Sachs, for one, will agree with that. Just Google it — you’ll get about 800,000 hits.

You got to open your eyes out there. … the government’s no help. How they just look the other way, since after they’re done stealing our money, they barely even have to pay any taxes on it! I’m telling you, it’s rigged. The whole goddamn thing. They’re stealing the country out from under us. Not the Muslims. Not the Chinese. Them.

It’s all fixed. They like how the math adds up, so they got to keep rewriting the equation. Which means, the one time you finally get a little extra money, you try and be smart about it, you turn on the TV. Boom. That’s how they fucking take it. They take it so fast they don’t even have to explain it! They literally own the airwaves. They literally control the information.

Also informative about Goldman Sachs is Budwell’s claim, “They take it so fast they don’t even have to explain it!” Many of us still remember the charges laid against Goldman in this respect. In brief:

While the SEC is busy investigating Goldman Sachs, it might want to look into another Goldman-dominated fraud: computerized front running using high-frequency trading programs. . . .Sort of like how the Kosher tax skims money off the food industry. I think what made the most pointed sense to me was Budwell’s linking of financial deceit with the power to create the (un)reality we see and hear: “They literally own the airwaves. They literally control the information.” This has been a key point others and I at TOO have made for years: Jews have immense media control throughout the West — and it’s killing us.

[Called] High Frequency Trading (HFT) or “black box trading,” automated program trading uses high-speed computers governed by complex algorithms (instructions to the computer) to analyze data and transact orders in massive quantities at very high speeds. Like the poker player peeking in a mirror to see his opponent’s cards, HFT allows the program trader to peek at major incoming orders and jump in front of them to skim profits off the top. And these large institutional orders are our money — our pension funds, mutual funds, and 401Ks.

White societies throughout the world have been and continue to be subverted culturally, diluted through scandalous levels of non-White immigration, and drained of wealth and treasure, which Greg Johnson of Counter-Currents summed up so accurately:

Jews, of course, more than any other people, are aware of the necessary conditions of collective survival. They are concerned to secure these conditions for their own people even as they deny them to us. The obvious conclusion is that they mean for us not to survive as a people. America is being corrupted, exploited, degraded, and murdered by the organized Jewish community.Johnson later added another idea relevant to my article here: “White Nationalism is an intellectual movement. We are a vast online educational project.” Indeed, TOO lives only on the Internet.

(I confess I was miffed when I read recently the following lines from Andrew Anglin in an otherwise good entry: “The grounds are fertile and the time has come for an open discussion about Jews in society. What we need now is an unironic, non-humorous take on the Jewish problem from serious people who are able to speak seriously about this serious problem.” Has TOO not been a leading source of serious discussion of this topic for two decades?)

Strike Through the Mask!

To recap, I’ll repeat the reasons for linking financial scandals with Hollywood: First, Jews run Hollywood. It is indeed an empire of their own. Second, Jews throughout modern history have been involved in immense financial scandals, reaching truly astonishing proportions in the last half century. Third, Jews use their Hollywood propaganda machine to obscure these facts. Case in point: This is the sixth major film I’ve featured that advances the deception about the Jewish role in financial skullduggery. As I’ve said, this is an explicit disinformation campaign.Again plugging the recent TOO article from “Publius,” we see how the author has gone through volumes of evidence of interlocking Jewish financial and political activity. He then adds a nice literary touch when he quotes this, then expounds further:

“So you see, my dear Coningsby,” the Jewish Benjamin Disraeli wrote in his novel Coningsby, “that the world is governed by very different personages from what is imagined by those who are not behind the scenes.” It is my goal — and if I may be so bold as to speak for others, that of the other writers at the Occidental Observer and other dissident voices I’m sure — to shoulder our way into the conversation and show plainly the architects of this modern horror show. With any luck, figures like Steyer and Bloomberg will continue to drop the mask and show the public who they really are, making our job that much easier. To combat the pernicious agenda of the globalist establishment, we must first understand it. We must know the what’s, the when’s, the where’s, the who’s, the why’s, and the how’s and proceed accordingly. [emphasis added]I’m glad Publius saw fit to mention the word mask, for that has been a driving theme of this essay. Joyce uses it by demanding that we “Strike through the mask!” and later explains how “these Jewish financiers also escape scrutiny by hiding behind the mask.”

I’ve tried desperately for years to help others see through this mask, in large part by examining the products Hollywood has inundated us with since the advent of moving pictures. My appeal to you is captured by Publius’s plea: “Do you see how all this works? This is how a decadent ruling class operates — governing for its own benefit and, for the preponderance of Jews, that of its tribe” [emphasis again added].

The half-dozen or so Hollywood films I’ve examined here at TOO play a central role in covering up what is so stunningly obvious. We need to understand these propaganda techniques and somehow teach others to see them as well. Otherwise, organized Jewry will continue to siphon off vast sums of money from the greater economy and employ it against the whole of the goyische world.

In closing, I’ll say that after “striking through the mask,” we must follow an observation from leading unmasker of Jewish behavior, E. Michael Jones, where he concludes a recent video with these simple but profound words: “Consciousness is the beginning of change.” MacDonald, Joyce, “Publius” — and, yes, Edmund Connelly — are doing everything humanly possible to “strike through the mask.”

========================

No comments:

Post a Comment